What Is the Options Wheel Strategy?

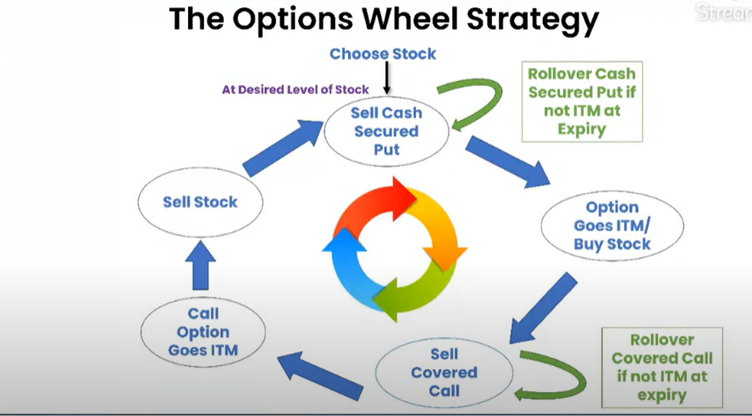

The Wheel Definition: In options trading, the "Wheel" is 4 step strategy that first involves selling a put option. If/when this put is assigned, you will be long stock. The next step is to sell a call option against this stock. If the underlying rises in prices, you will be "called out" on the stock, resulting in a flat position. Repeating this process creates "the wheel".

The wheel strategy is a great, long-term options trading strategy best suited for traders looking to generate income. In this article, we will review step-by-step how this income strategy profits.